Today let’s talk about why, after a while, you realize that the money you kept for an instant is not worth what you expected. But wait! And everything is about the prices of cereals, food and fuel.

Table of Contents

The world is suffering from prices, to be specific, the prices are terrifying everywhere. Inflation is no where near of stopping at least in the short-term. Rwanda has had 20.7% of inflation by January 2023, 0.9 percentage less than that of December 2022.

This clearly shows how bad things are at this point, however with some hope that the inflation is going downward even though it is far from the medium term target values; the forecast tells.

I know that the central bank is ready and cautious to take any hard decision in what it does to avoid making things even worse. But, what needs to be done anyway?

Basically, this is a work that needs serious attention especially in perspective of developing countries like Rwanda. As of now in a period of three (3) quarters, the CBR has jumped up 2 percentage points (i.e. from 5 to 7%).

What does inflation mean in the first place?

This is one of the basic things to know, whether you are an economist or not because inflation is an evil to all of us in the sense of our purchasing power, especially when it is high like today.

Inflation is the change in general price levels. This change is referred to a specific period of time, for example, month, quarter or year. Inflation can have a direct impact on costs of living and monetary value of the economy. [1]https://www.elibrary.imf.org/downloadpdf/journals/022/0047/001/article-A017-en.pdf

Inflation indicators are compiled from the Consumer Price Index which is a measure of price of a basket of goods that share similar nature, that being said, a pen cannot be in the same basket with an Irish potato.

Inflation can be explored in details by disaggregating it into different components, for example food, services, energy, and more. This is important for investigating more the dynamics of inflation.

This disaggregation will help us to reveal any underlying driver within the general price changes, for example the drivers of inflation during the pandemic may be different on what were the drivers of inflation during the 2008 financial crisis.

Studies show that countries have different priorities in inflation watch, for example most of the sub-Saharan countries’ inflation monitoring depends on food and non-alcoholic beverages due to the high share of food in the CPI because it is one of the most crucial goods in the life of households. [2]Nguyen, A. D. M., Dridi, J., Unsal, F. D., & Williams, O. (2015). On the Drivers of Inflation in Sub-Saharan Africa, IMF Working Papers, 2015(189), A001. Retrieved Mar 8, 2023, from … Continue reading

In this post I will show the current trends in food and non-alcoholic beverages inflation as one of crucial components of consumer price index.

This post explores the available data and also uses near-term forecasting to guess how food and non-alcoholic beverages inflation may look like in the near future.

Food Inflation makes you pay high

To combat inflationary pressures, the National Bank of Rwanda increased its central bank rate by 0.5% (rising from 6.5% to 7%).

Let’s first of all see what the behaviors of food inflation are.

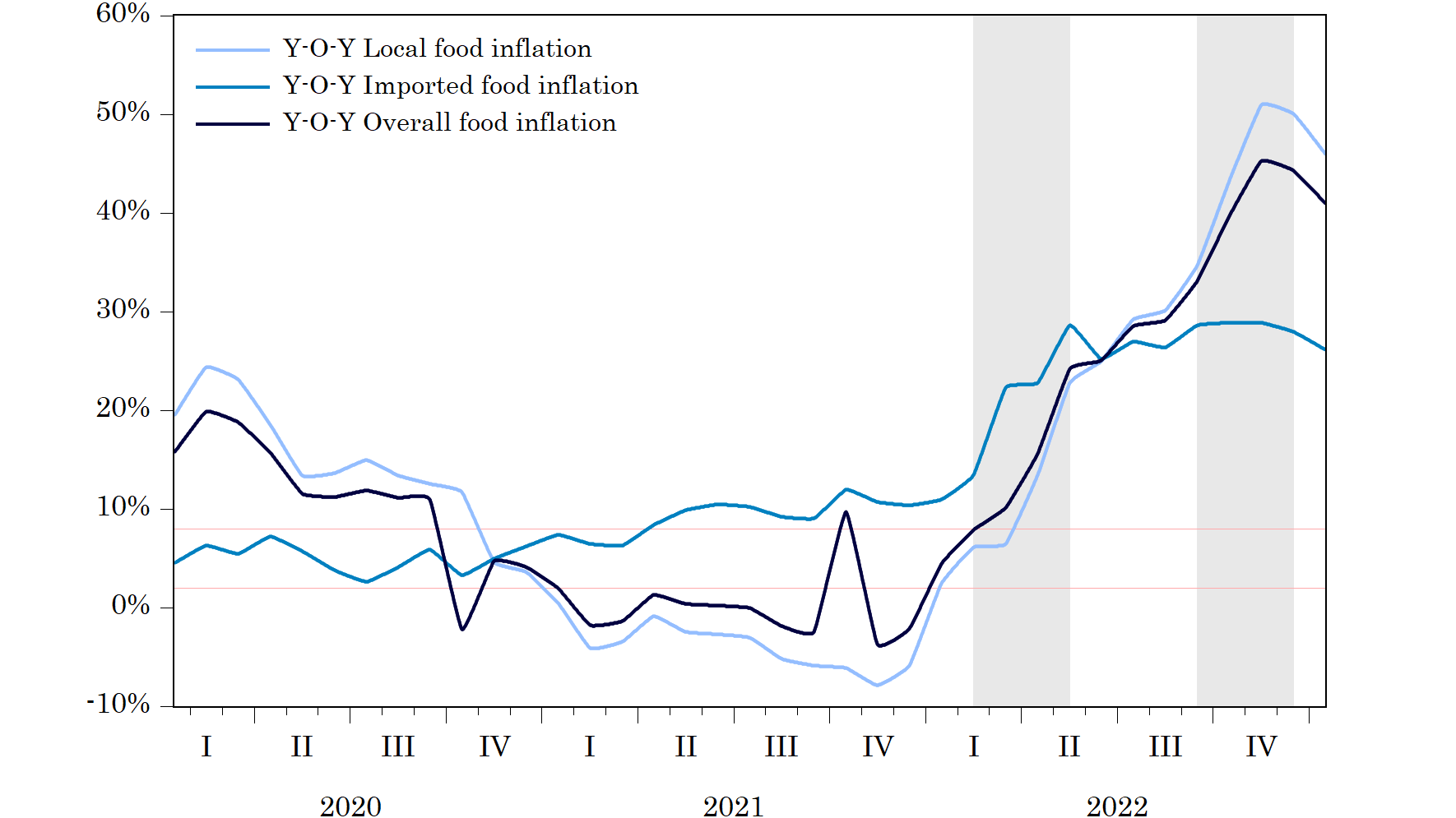

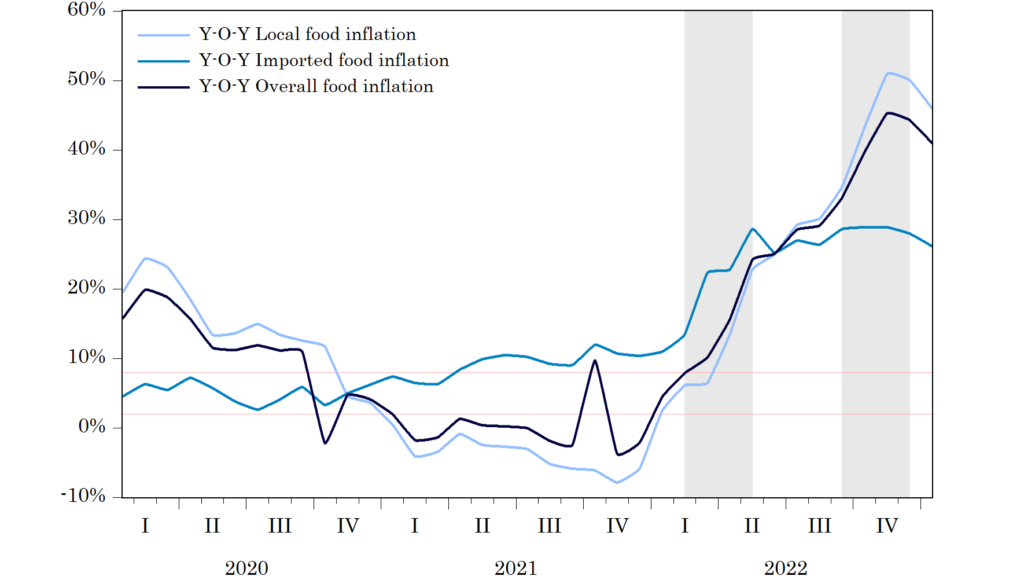

Looking at the trend in Figure 1, since the start of the Russia-Ukraine war, food inflationary pressures have been increasing at a higher pace from February 2022 to May 2022 in both local and imported food.

However, there has been a short-term deceleration from June to September 2022 in all components of inflation but took the pace again afterwards.

This definitely gives a serious warning to economic agents:

Since the Ukraine-Russia war, the component no longer behaved as normal; here, the inflation was not changing consistently but since then it started to explode.

From Figure 1, the inflation seemed to be under the radar of the inflation boundaries of the central bank (i.e., lower: 2%, medium: 5%, and upper: 8%) until February 2022, when it spiked from roughly 10% to 45% in November 2022, the highest inflation value so far.

Moreover, from November 2022 through January 2023, the inflation has begun to drop; by making reference to this date the article is published with the available data.

It is visible that the food and non-alcoholic beverage import inflation rate is small compared to the local inflation. The two possible causes of this gap are:

- Low agricultural production as a result of unfavorable weather has raised prices for agricultural goods and increased inflationary pressures [3]BNR. (2022). Monetary Policy Report..

- The rise in import costs of agriculture inputs like fertilizers has put pressure on agricultural commodities’ prices.

The combination of the aforementioned factors has caused local food and non-alcoholic drinks to have significantly higher inflation rates than imported goods of a comparable nature.

Forecast

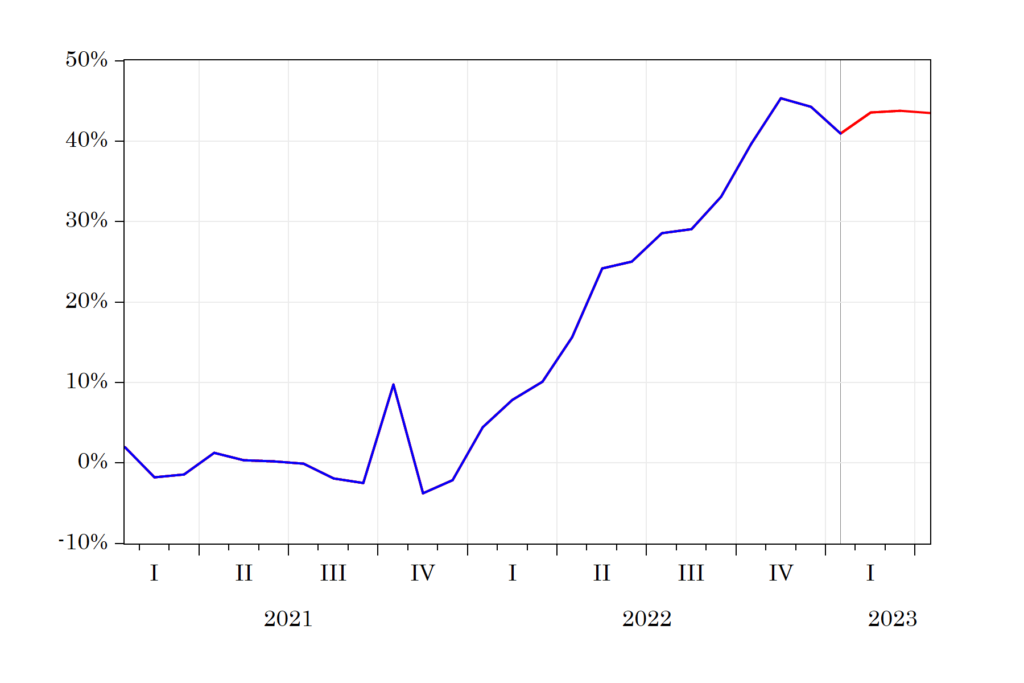

In this part, I used near-term forecasting (NTF) to project inflation in food and non-alcoholic drinks for the next quarter (i.e., from February 2023 to April 2023).

All else being equal, the forecast shows some signs of an overall decline in inflationary pressures. However, the forecasts, on the other hand, show that inflation can still be resistant to a significant downturn.

Nevertheless, this is generally a good sign of recovery, with the hope that inflation may return at least near the band.

For example, in February 2023, the year-over-year inflation rate for food and non-alcoholic beverages is expected to increase to 43% from 40% in January 2023. This rate will remain in that range for the next two months.

But, with the same pace as the rates generated by the forecast, the inflation may last a little bit longer before it starts to make a significant decline.

What can you do if the price you pay on food is high?

The answer to this question is simple. Prioritize your expenditures; that is a general answer I can give to anyone who may ask the same question. Why?

The decision of the central bank to increase the central bank rate is not to penalize you, not even close! The bank wants to show you that you have to make optimal choices in your expenditures.

Here is the gist, when the central bank charges commercial banks a higher interest rate, the commercial banks will raise the rates they give to individuals and companies looking to borrow money.

If you see that your budget can no longer afford what it used to buy last year and the cost of borrowing increases, it will be hard for you or make you think twice before you act.

In this case, the only remaining option is to readjust your budget and prioritize your spending patterns. See? You may forego a pair of shoes or apparel you used to buy to be able to satisfy your needs for food or heating.

References